Starting a military career comes with both excitement and financial challenges. From uniforms and gear to transportation and housing, the transition into service can be costly.

That’s where the Navy Federal Career Starter Loan—also known as the Career Kickoff Loan—comes in. Offered by Navy Federal Credit Union, this low-rate personal loan is designed to give new officers the financial breathing room they need at the start of their careers.

What Is the Navy Federal Career Starter Loan?

The Career Starter Loan is a special financing option available to cadets, midshipmen, and newly commissioned officers in the U.S. military. Unlike standard personal loans, it comes with significantly reduced interest rates, flexible repayment terms, and the ability to defer payments until after graduation or commissioning.

In short, it’s a way for new officers to cover early expenses while building strong credit and avoiding high-interest debt.

Who’s Eligible and What Are the Terms?

The exact loan amount, interest rate, and repayment timeline depend on your commissioning path.

For service academy cadets and midshipmen, the program is especially generous. You can borrow up to $36,000 at rates as low as 0.75% APR, with repayment beginning 90 days after graduation. The loan term can stretch up to 60 months, and there are no prepayment penalties—so you can pay it off early if you choose.

For ROTC graduates, OCS/OTS candidates, warrant officers, and limited duty officers (LDOs), the maximum loan amount is $25,000 with an interest rate of 2.99% APR. Repayment typically starts 180 days after commissioning, or 45 days if you’ve already been commissioned when the loan is approved. As with academy cadets, you’ll have up to five years to repay the loan.

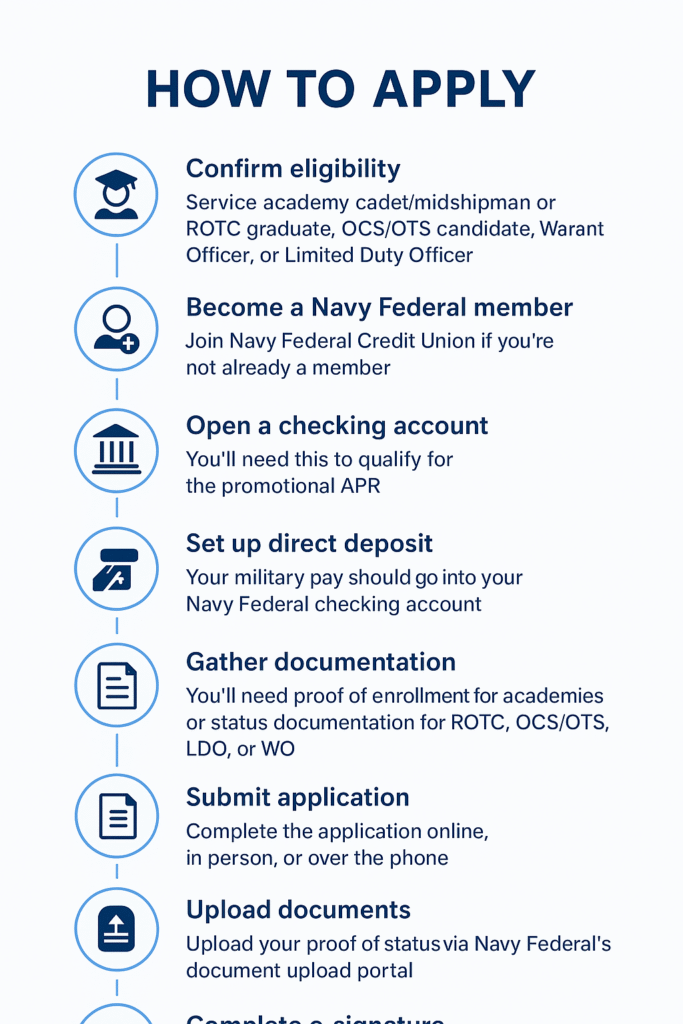

How to Apply

1) Confirm you’re eligible

Make sure you fit one of the groups the Navy Federal Career Starter Loan (Career Kickoff Loan) is built for:

-

Service academy cadet/midshipman (USMA, USNA, USAFA, USCGA, USMMA), or

-

ROTC graduate, OCS/OTS candidate, Warrant Officer, or Limited Duty Officer (LDO).

Tip: Your path determines your max amount, APR, and when payments start.

2) Become (or verify you are) a Navy Federal member

If you’re not already a member, join Navy Federal Credit Union. Membership is open to servicemembers, veterans, cadets/midshipmen, and eligible family members.

-

If you’re already a member, confirm your profile info is current (address, phone, email).

3) Open a Navy Federal checking account

The promotional APR on the Career Starter Loan generally requires an active Navy Federal checking account. Open one if you don’t already have it.

4) Set up direct deposit of your military pay

Arrange for your military pay to be deposited into your Navy Federal checking.

-

This is key to keeping the promotional APR—don’t skip it.

-

If your pay hasn’t started yet, schedule it for when it does (e.g., after commissioning/graduation).

5) Gather your documentation (varies by path)

Have clear, legible copies ready:

-

Academy: Proof of enrollment/status (e.g., academy documentation).

-

ROTC: Duty Status Verification or commissioning documentation.

-

OCS/OTS/LDO/WO: A signed letter or official documentation from your command.

Also have a government ID and any additional items Navy Federal requests (they’ll tell you if they need more).

6) Time your application

-

Academy cadets/mids often apply in the final year before graduation.

-

ROTC/OCS/OTS/LDO/WO candidates typically apply near commissioning or shortly before.

Applying too early without the right proof can slow things down; applying too late can delay funding.

7) Submit the application

Choose one of three routes:

-

Online: Start the Career Starter Loan application in your Navy Federal digital banking.

-

In person: Visit a branch (helpful if you want someone to review documents on the spot).

-

By phone: A rep can walk you through and tell you how to upload documents.

8) Upload your documents

Use Navy Federal’s secure document upload (online or via the app) or hand them to a branch rep. Double-check that names, dates, and positions match your application exactly to avoid delays.

9) Complete identity and income verification

Be ready to verify your identity and (if requested) expected pay/commissioning details. Keep your phone nearby in case the loan team needs a quick clarification.

10) Review your offer and eSign

If approved, you’ll see your loan amount, APR, term, and first payment date (deferred based on your path). Review carefully, then eSign the promissory note.

11) Receive funding

Funds are typically deposited into your Navy Federal account you selected during the application. Check your balance and confirm receipt before making large purchases.

12) Set up autopay and calendar reminders

-

Turn on autopay from your Navy Federal checking to avoid missed payments.

-

Add two reminders:

-

End of deferment date (when payments begin), and

-

First due date (often differs slightly based on origination/commissioning timing).

-

13) Maintain the promo rate conditions

Keep your NFCU checking and direct deposit active for the life of the loan. If you remove either, your APR may revert to a higher standard personal-loan rate. If you change duty stations or payroll systems, reconfirm your direct deposit is still pointing to Navy Federal.

14) Pay off early if you wish (no prepayment penalty)

If you want to accelerate payoff, you can—without fees. Just make sure extra payments go to principal.

Smart Ways to Use the Loan

The Career Starter Loan was designed to ease the financial burden of beginning your military career. Many new officers use it to purchase a car, secure housing, or pay for uniforms and moving costs. Others take advantage of the low interest rate to consolidate higher-interest debt, saving money in the long run.

Some financially savvy servicemembers even use part of the loan to invest in certificates of deposit (CDs), Treasury bills, or low-cost index funds, potentially earning a return greater than the loan’s interest rate. While this can be a smart strategy, it’s important to remember that investing always carries risk—and repayment on the loan is guaranteed.

Things to Keep in Mind About the Loan

Although the Navy Federal Career Starter Loan is one of the best financing options available to new officers, it’s still debt. Borrow only what you truly need, and avoid the temptation to use the full loan amount if it’s unnecessary. Over-borrowing can lead to repayment stress down the road.

You’ll also want to maintain your checking account and direct deposit throughout the life of the loan. If you stop meeting those conditions, your low promotional interest rate may revert to Navy Federal’s standard personal loan rate, which is significantly higher.

Why This Loan Matters?

For servicemembers beginning their careers, financial stability can be just as important as professional readiness. The Navy Federal Career Starter Loan provides a unique opportunity to access affordable credit, establish strong financial habits, and avoid the trap of high-interest debt.

At WiseWorq, we believe in making financial and business information accessible, clear, and actionable. The Career Starter Loan is a prime example of a financial tool that—when used wisely—can set military officers on the path to long-term success.

👉 Bottom line: The Navy Federal Career Starter Loan is one of the most valuable benefits available to cadets, midshipmen, and new officers. With low interest, deferred payments, and flexible terms, it’s a smart way to manage early expenses and start your career on solid financial footing.